Evergreen Principles

2Q 2025

Dear Fellow Partners & Friends,

During the second quarter, the Centerstone Investors Fund (CENTX) continued to benefit from its long-held exposures to European equities and currencies, as well as its gold-related investments. Throughout much of the year, elevated cash reserves have also helped dampen the volatility that has characterized markets year-to-date . Interest rate adjustments and geopolitical tensions overseas have further complicated investor sentiment. Despite this persistent backdrop of uncertainty, the Investors Fund has found itself—perhaps coincidentally—well-positioned in the current environment.

We have long believed that many outstanding companies exist around the world, often trading at significant discounts compared to their US-listed counterparts.

FOREIGN FOCUS

A defining feature of the fund since inception has been its outsized exposure to foreign equities. We have long believed that many outstanding companies exist around the world, often trading at significant discounts compared to their US-listed counterparts. While such discounts can sometimes reflect deficiencies in business quality, management, or financial strength, most of the fund’s foreign holdings score well on these metrics. As the stock prices of many of these companies have rebounded during this challenging year, it seems global investors may be rediscovering the vast opportunities that exist outside the large US technology sector. If the global economy is indeed fragmenting and “localizing,” it stands to reason that investors would favor companies somewhat insulated from the negative effects of “de-globalization.” In our portfolio, these include companies such as ISS¹, Air Liquide², Eurofins³, and Loomis⁴. Most of our foreign holdings are, to varying degrees, local operators: ISS provides cleaning and related services in Europe and the US; Air Liquide generates the majority of its revenues locally due to the high cost of transporting industrial gases; and Eurofins’ testing and certification services are tailored to the specific countries in which it operates. These are just a few examples of strong, foreign-listed companies that have been well-positioned to weather this year’s challenges—and, not coincidentally, have been among the fund’s better performers.

As noted, the fund has also benefited from its foreign currency exposure. We employ an active currency hedging strategy to protect returns when appropriate, however, only hedge the currencies to which we are exposed, rarely for speculative reasons. This is a defensive tactic, and at times, as has been the case for much of this year, we see no need for such defense and remain unhedged. Consequently, the fund has benefited from its unhedged exposure to foreign equities.

A HEDGE AGAINST UNCERTAINTY

Gold’s role in our portfolio, as long-time investors are familiar with, is straightforward: gold serves as a hedge against uncertainty. Over the years, that uncertainty has manifested as inflation, deflation, currency devaluations, and more. The key point is that we rarely know in advance why gold will move as it does; only in hindsight do we assign reasons. The only real certainty is that uncertainty will persist, and thus, there is always a place for gold in a portfolio.

Gold’s role in our portfolio, as long-time investors are familiar with, is straightforward: gold serves as a hedge against uncertainty.

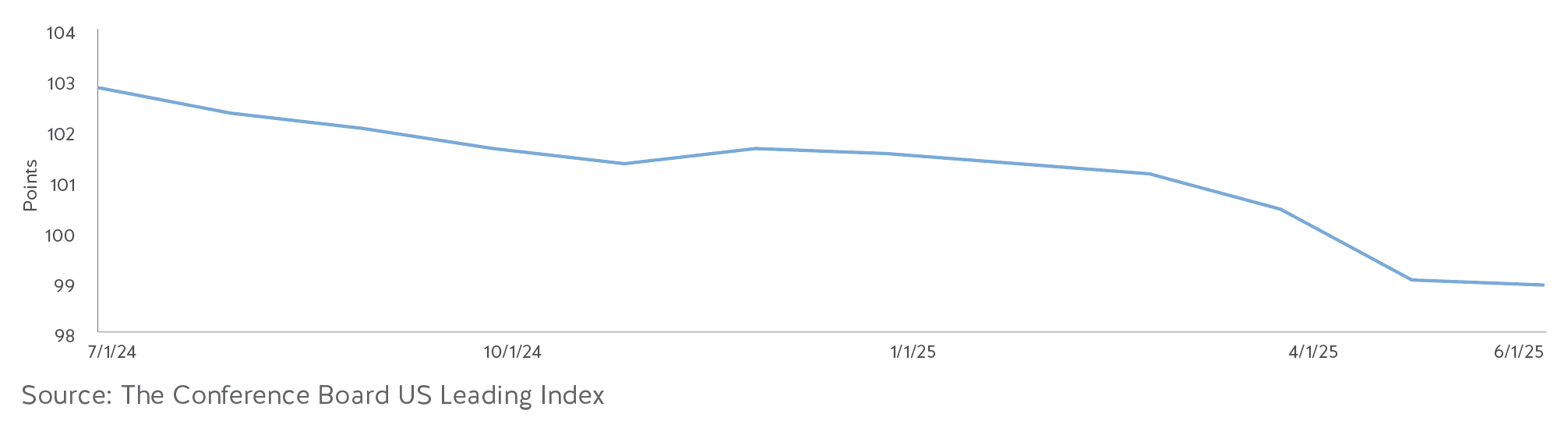

LEADING ECONOMIC INDICATORS WEAKENING

RESERVE MANAGEMENT

In addition to gold, the fund typically holds reserves in the form of cash or short-duration Treasury notes. With yields around 4%, we believe it is reasonable to maintain a higher cash position while we await greater clarity in the global trading environment. Additionally, with leading economic indicators weakening (as illustrated above), stubborn inflation, elevated valuations and highly concentrated, tech-heavy indices, prudence suggests perhaps holding a bit more cash.

…with leading economic indicators weakening, stubborn inflation, elevated valuations and highly concentrated, tech-heavy indices, prudence suggests perhaps holding a bit more cash.

These days, surprises seem to lurk around every corner, making it challenging to write commentary that does not quickly become outdated. However, some principles remain evergreen: (1) Good businesses, well-capitalized and led by capable management teams, tend to remain good businesses; and (2) the stock prices of such businesses, if purchased at reasonable valuations, tend to appreciate over time. These two simple ideas are the centerstone of our investment philosophy.

…some principles remain evergreen: (1) Good businesses, well-capitalized and led by capable management teams, tend to remain good businesses; and (2) the stock prices of such businesses, if purchased at reasonable valuations, tend to appreciate over time. These two simple ideas are the centerstone of our investment philosophy.

Thank you for your continued trust and support. We hope you have a great summer.

Sincerely,

Abhay Deshpande, CFA

Chief Investment Officer

1 1.40% position in the Centerstone Investors Fund as of March 31, 2025.

2 0.51% position in the Centerstone Investors Fund as of March 31, 2025.

3 2.53% position in the Centerstone Investors Fund as of March 31, 2025.

4 1.26% position in the Centerstone Investors Fund as of March 31, 2025.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Centerstone Funds. This and other important information about the Funds are contained in the prospectus, which can be obtained by calling 877.314.9006. The prospectus should be read carefully before investing. For further information about the Centerstone Funds, please call 877.314.9006. The Centerstone Funds are distributed by Northern Lights Distributors, LLC, Member FINRA/SIPC.

The commentary represents the opinion of Centerstone Investors as of June 2025 and is subject to change based on market and other conditions. These opinions are not intended to be a forecast of future events, a guarantee of future results or investment advice. Any statistics contained here have been obtained from sources believed to be reliable, but the accuracy of this information cannot be guaranteed. The views expressed herein may change at any time subsequent to the date of issue hereof. The information provided is not to be construed as a recommendation or an offer to buy or sell or the solicitation of an offer to buy or sell any fund or security.

An investment in the Funds entails risk including possible loss of principal. There can be no assurance that the Funds will achieve their investment objective.

Past performance is no guarantee of future results.

The value of the Funds portfolio holdings may fluctuate in response to events specific to the companies or markets in which the Funds invest, as well as economic, political, or social events in the United States or abroad. The impact of the coronavirus (COVID-19), and other epidemics and pandemics that may arise in the future, could affect the economies of many nations, individual companies and the market in general in ways that cannot necessarily be foreseen at the present time.

Value investing involves buying stocks that are out of favor and/or undervalued in comparison to their peers or their prospects for growth. Our value strategy may not meet its investment objective and you could lose money by investing in the Centerstone Funds. Value investing involves the risk that such securities may not reach their expected market value, causing the Funds to underperform other equity funds that use different investing styles.

Investments in foreign securities could subject the Funds to greater risks including currency fluctuation, economic conditions, and different governmental and accounting standards. Foreign common stocks and currency strategies will subject the Funds to currency trading risks that include market risk, credit risk and country risk. There can be no assurance that the Funds’ hedging strategy will reduce risk or that hedging transactions will be either available or cost effective. The Funds use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments.

Domestic economic growth and market conditions, interest rate levels, and political events are among the factors affecting the securities markets in which the Funds invest.

Investing in the commodities markets through commodity-linked ETFs, ETNs and mutual funds will subject the Funds to potentially greater volatility than traditional securities.

Large-cap company risk is the risk that established companies may be unable to respond quickly to new competitive challenges such as changes in consumer tastes or innovative smaller competitors. Investments in lesser-known, small and medium capitalization companies may be more vulnerable than larger, more established organizations. Securities in small and mid-cap companies may be more volatile and less liquid than the securities of companies with larger market capitalizations.